In recent years, the financial and banking sectors have undergone a radical transformation. In particular, over the past year and a half, the policy of providing financial services has changed significantly. In this article, we'll take a look at the top fintech trends of 2021.

In the summer of 2020, financial company Plaid, together with The Harris Poll, conducted a survey of 2,000 people. The results illustrated that 59% of people have used more fintech money management apps since the COVID-19 hit than before the pandemic. 69% say technology has helped them save time, money and stress when managing their finances. This growth was driven by the use of contactless payment applications, digital banks and other tools. But these are not just solutions for times of crisis. Also, this American survey showed that 73% of people plan to continue using digital banking technologies after the restrictions are over. We'll talk more about the best fintech trends below.

1 Digital banks

Digital banking became a popular cash management method even before the outbreak of the pandemic. But digital fintech services are preferred today as they minimize the need to stand in long lines at bank branches. Digital banking includes services such as P2P transfers, cryptocurrency sales, contactless payments, international money transfers, etc.

BCG experts predict that the number of people visiting bank branches will decrease by up to 30%. In addition to convenience and security, digital banks provide accessibility, including to people who have not had the opportunity to use banking services before.

2 Blockchain and decentralized finance

As one of the most important technologies to emerge in recent years, blockchain is among the fintech trends with the greatest potential. Its applications in the financial industry are enormous.

Blockchain solutions have staged a real banking revolution, triggering the transition from centralized procedures to safer, more transparent ones. Blockchain offers a decentralized ledger of end-to-end transactions that, once automatically entered, cannot be changed in any way. The benefits of blockchain to the fintech industry are numerous, including:

Transparency - the blockchain provides open information about all transactions carried out, while maintaining the anonymity of participants in financial transactions.

Instant settlements - where calculations previously took up to a week, with blockchain they can take seconds. This will save all parties involved a tremendous amount of time and money.

Smart Contracts - Smart contracts with incorruptible business rules will improve performance in terms of timing as they automatically take effect after certain parameters are met. This will be especially beneficial for complex transactions with financial assets.

Capital Optimization - Blockchain can significantly reduce operating costs for the financial sector as it eliminates the need for intermediaries such as custodian banks and clearing companies.

3 Cloud solutions (SAAS)

According to the developer of hardware and software cluster virtualized complexes "Nutanix" in Russia investments in cloud storage increased by 56%.

The driving force behind the move to the cloud is the growing importance of open banking, which is gaining traction due to its ability to provide greater transparency. In addition, the troubles caused by the pandemic mean that financial institutions have no choice but to rely on cloud-based solutions.

4 Digital transformation and robotization of absolutely all processes

Robotic process automation allows you to optimize operations, reduce the burden on people associated with repetitive tasks, and significantly improve the efficiency of banking.

The introduction of robotization will speed up and reduce the cost of many of the time-consuming internal processes associated with managing a financial institution, such as maintaining accounts, acquiring new customers, and processing loans.

As a result, organizations can devote their human resources to the development of key areas such as customer service, thereby improving the quality of services, as well as significantly increasing business efficiency.

5 Autonomous financing using artificial intelligence and machine learning

With the help of artificial intelligence and machine learning technologies, innovative fintech companies can automate their financial decision-making process and save valuable time for their customers.

AI and ML are also enabling fintech firms to use Big Data to find patterns in customer behavior that could lead to smarter financial decisions. With this technology, they can effectively tailor their products and services according to the wishes of the consumers.

At Tiqum, we are currently developing an intellectual consultant Immata that can help make the right decisions based on an analysis of customer spending and preferences.

6 Collecting and analyzing detailed customer information

Fintech companies can use customer survey data and their interaction with the brand to collect and analyze information. In addition, linguistic analysis and language identification can collect a lot of data from telephone conversations between customers and customer service centers, much of which is unstructured and unused.

Such technology can help brands understand the customer's intentions at the time of the call, his behavior and reaction to the service or product of interest. This will enable companies to better tailor their services to meet customer expectations.

7 Cybersecurity comes to the fore

At the World Economic Forum 2021, which was held online, according to Interpol, in 2021 cybercrime losses are expected to increase to $ 6 trillion. The development of IT technologies in all industries, including the financial sector, has created many opportunities for cybercriminals.

Given the nature of information held by financial institutions, it should come as no surprise that cybersecurity represents one of the largest branches for the development of the sector. In fact, the financial industry is one of the top three targets of cybercrime, accounting for about 10% of all annual attacks.

8 Biometric security systems

With the aforementioned rise in cybercrime, financial institutions are looking for new ways to protect sensitive financial customer data. Passwords are losing their strength in the face of rapidly evolving criminal technologies, which is why biometric security measures are the next logical step in ensuring financial security.

Many are already familiar with things like fingerprint identification, but a growing number of banks, including HSBC and First Direct, are looking to leverage fintech trends like face and voice recognition to keep their customers safe. It is not only safer than a password, but also much easier for the client. Instead of memorizing combinations of letters and numbers, answers to security questions to gain access to your finances, it will now be enough to simply use biometrics. It also saves the bank time and avoids mistakes.

This technology can also be applied to ATMs, eliminating the need for a traditional PIN.

Tiqum has been in fintech for 8 years and this is just the beginning

We, as a Digital company, also keep pace with the times, helping our clients to remain relevant and productive in today's realities. Each case we solve, one way or another uses one or more of the listed trends.

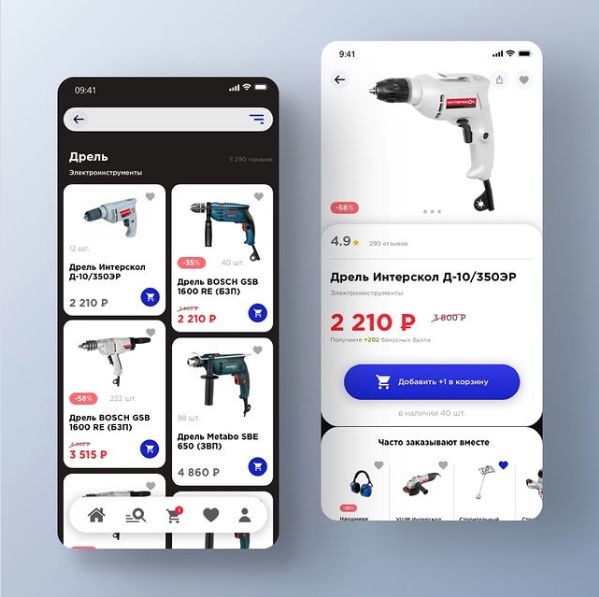

In the field of finance, we have succeeded, having applied our expertise in several projects of Uralsib Bank, namely: a website, a mobile application, a payment terminal interface, a client's personal account, and an Internet bank. Also, the AI financial assistant Immata is currently being developed, the first task of which will be to help you choose the most suitable package of cards with cashback for your spending (sometimes it is more profitable to get 2-3 cards and choose the right one to pay to get tens of thousands of cashback).

COVID gave a serious impetus to the development of fintech

Nearly every industry has been forced to rethink traditional business models due to the COVID pandemic. And many, including the financial sector, will never look the same again.

If we have learned anything from the events of 2020/21, it is that flexibility and innovation are the keys to business survival. Financial models must be malleable, able to leverage the latest trends in fintech, and provide banking services that are relevant to individuals and the general public.